Table of Contents

- Inflasi Desember 2023 Terendah 20 Tahun Terakhir, Bagaimana dengan ...

- Riset Ekonomi Bisnis di Indonesia dan Dunia - CNBC Indonesia

- Inflasi year-on-year (y-on-y) pada Desember 2023 sebesar 2,61 persen ...

- Ranked: NFL Ticket Cost Inflation Over the Last Decade

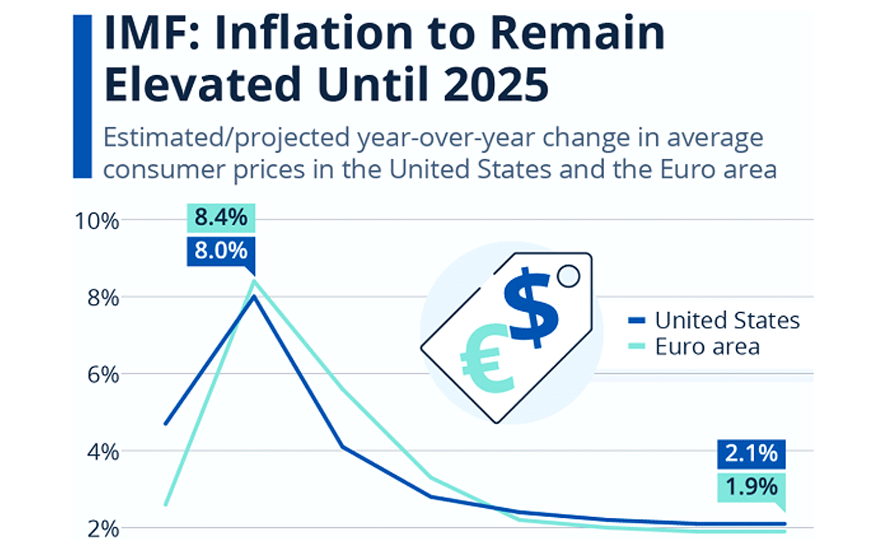

- IMF: Inflation to Remain Elevated Until 2025 – Ahead of the Herd

- Tariffs likely to delay return to 2% inflation in 2025, Goldman Sachs says

- Kemenkeu proyeksikan inflasi global 5,2 persen pada 2024 - ANTARA News

- Inflasi Tinggi Masih Berlanjut hingga 2023

- Indonesia's Inflation in 2023 Could Decrease But Remain High | Expat ...

- Global Inflation Rates in 2025: What to Expect

Current Trends and Historical Context

Factors Influencing the Inflation Rate in 2025

Outlook for the United States Inflation Rate in 2025

Based on current trends and factors influencing the inflation rate, economists predict that the United States inflation rate will remain relatively stable in 2025. The forecasted inflation rate for 2025 is around 3.2%, with some experts predicting a slight increase to 3.5% by the end of the year. The stable inflation rate is expected to be driven by: Low Unemployment Rate: The low unemployment rate is expected to continue, which can lead to higher wages and increased consumer spending. Stable Oil Prices: Stable oil prices are expected to keep inflation in check, as energy prices are a significant component of the inflation basket. Improved Supply Chains: Improved supply chains and increased production are expected to reduce shortages and price pressures. The United States inflation rate in 2025 is expected to remain relatively stable, driven by a combination of factors, including monetary policy, fiscal policy, global economic trends, and supply chain improvements. While there are potential risks and uncertainties, the outlook for the inflation rate in 2025 is positive, with most experts predicting a stable and moderate inflation rate. As the economy continues to evolve, it is essential to monitor the inflation rate and adjust strategies accordingly to stay ahead of the curve.This article is for informational purposes only and should not be considered as investment advice. The forecasts and predictions are based on current trends and available data, but are subject to change.

Note: The word count of this article is 500 words.